106pay.site

Learn

Sp Futures Price

Find information for E-mini S&P Futures Quotes provided by CME Group. View Quotes. S&P index futures provide exposure to individual stocks in the index. But trading futures is different from trading equities. Pre-markets ; Dow Futures. 40, + ; S&P Futures. 5, + ; NASDAQ Futures. 19, + Generic 1st 'ES' Future. Following Follow Follow. ES1:IND. Following Follow Follow ; 5, USD. AM. p ; 5, USD. Sep 8/13 ; 5, USD. Sep. September S&P ® Futures Excess Return Index Supplement to the Underlier Supplement, the Prospectus Supplement and the Prospectus, each as may be amended. Get the latest data and news on E-Mini S&P Future Continuous Contract prices today from The Walll Street Journal. % · Pre. Settlement -- · Settlement Date · Open 5, · Bid 5, · Last Price 5, · Day's Range 5, - 5, · Volume M · Ask. E-mini S&P futures have made futures trading more accessible to traders and they are the most commonly traded U.S. stock index future offered at the CME. In. With ES futures, you can take positions on S&P performance electronically. Find information for E-mini S&P Futures Quotes provided by CME Group. View Quotes. S&P index futures provide exposure to individual stocks in the index. But trading futures is different from trading equities. Pre-markets ; Dow Futures. 40, + ; S&P Futures. 5, + ; NASDAQ Futures. 19, + Generic 1st 'ES' Future. Following Follow Follow. ES1:IND. Following Follow Follow ; 5, USD. AM. p ; 5, USD. Sep 8/13 ; 5, USD. Sep. September S&P ® Futures Excess Return Index Supplement to the Underlier Supplement, the Prospectus Supplement and the Prospectus, each as may be amended. Get the latest data and news on E-Mini S&P Future Continuous Contract prices today from The Walll Street Journal. % · Pre. Settlement -- · Settlement Date · Open 5, · Bid 5, · Last Price 5, · Day's Range 5, - 5, · Volume M · Ask. E-mini S&P futures have made futures trading more accessible to traders and they are the most commonly traded U.S. stock index future offered at the CME. In. With ES futures, you can take positions on S&P performance electronically.

Open $5, ; Day Range 5, - 5, ; 52 Week Range 4, - 5, ; Open Interest 1,, ; 5 Day. %.

S&P Futures Historical Data ; Sep 12, , 5,, 5,, 5,, 5, ; Sep 11, , 5,, 5,, 5,, 5, S&P Futures, also known as E-mini, is a stock market index futures contract traded on the Chicago Mercantile Exchange`s Globex electronic trading platform. Micro S&P Futures Contract allows trading today future price forecasts of the stock portfolio represented by the S&P Index, thus meeting the demand. S&P E-mini daily price charts for the futures contract. See TradingCharts for many more commodity/futures quotes, charts and news. S&P Futures - Sep 24 ; Prev. Close: 5, ; Open: 5, ; Day's Range: 5,, ; 52 wk Range: 4,, ; 1-Year Change: %. Image: Stock and futures charts. One is showing price activity of S&P futures. S&P Futures S&P Index. Before the US market opened, it was known. S&P futures are a type of derivative contract that provides buyers with an investment price based on the expectation of the S&P Index's future value. S&P Index overview: see client sentiment and spot trading opportunities for IG's US stock index which is based on S&P Index. The index is constructed from the front-quarter E-mini futures contract on the S&P It is part of the S&P Factor Series, which measures the inherent. S&P Futures, also known as E-mini, is a stock market index futures contract traded on the Chicago Mercantile Exchange`s Globex electronic trading platform. MONTH, LAST, CHG, OPEN, HIGH, LOW, DATE, TIME. E-Mini S&P Future Sep , , , , , , 09/13/24, The S&P Index ($SPX) (SPY) today is up by +%, the Dow Jones Industrials Index ($DOWI) (DIA) is up by +%, and the Nasdaq Index ($IUXX) (QQQ) is. Complete E-Mini S&P Future Continuous Contract futures overview by Barron's. View the ES00 futures and commodity market news with real-time price data. S&P E-Mini Futures Market News and Commentary · Contract Specifications · Seasonal Chart · Commitment of Traders Positions as of Sep 3, · Price Performance. Adjusted close price adjusted for splits and dividend and/or capital gain distributions. S&P Futures. 5, + (+%) · Dow Futures. 40, + Get the latest E-mini S&P price (ES) as well as the latest futures prices and other commodity market news at Nasdaq. S&P Index Futures Contract Specifications ; Contract Size, Each futures contract shall be valued at $ times the Standard and Poor's Stock Price. US STOCK MARKETS FUTURES ; DOW JONES Futures. 41, ; NASDAQ Futures. 19, ; S&P Futures. 5, The index is constructed from the front-quarter E-mini futures contract on the S&P It is part of the S&P Factor Series, which measures the inherent. E-Mini S&P Index Futures Contracts Specifications ; Exchange. CME GLOBEX, CME GLOBEX ; Contract point value, $50 USD, $5 USD ; Minimum price fluctuation, .

Does Medicare Plan F Cover Silver Sneakers

Remember most plans do not offer Silver Sneakers. Check out our Silver Sneakers Search tool to see if there are any in your area. You can see which Medigap. Does Blue Shield Medigap cover Silver Sneakers? Yes! Most Blue Shield Medigap plans include a membership to Silver Sneakers. SilverSneakers is the premier. Original Medicare doesn't cover gym memberships or fitness programs like SilverSneakers. However, some Medicare Part C and Medigap plans do. If you're. Medicare Supplement Insurance Plans are identified by the letters A, B, C, D, F, G, M, and N. Each plan covers different costs that Original Medicare doesn't. The SilverSneakers fitness program, offered at no additional cost to seniors on eligible Medicare plans, helps you get active and connect with others. SilverSneakers may also be covered by Medicare part C. You can check to see if your Medicare plan covers this program online. So, find a new favorite. Medicare does not cover the costs of fitness programs and gym memberships. Thus, Original Medicare does not cover the cost of SilverSneakers. Medicare Advantage. As a Blue Cross Blue Shield member, your health plan may already include SilverSneakers program membership as an added benefit. That means free gym access. Most Medicare Advantage (Part C) Plans include a SilverSneakers membership. First, you must be signed up for Original Medicare. Then you can select a Medicare. Remember most plans do not offer Silver Sneakers. Check out our Silver Sneakers Search tool to see if there are any in your area. You can see which Medigap. Does Blue Shield Medigap cover Silver Sneakers? Yes! Most Blue Shield Medigap plans include a membership to Silver Sneakers. SilverSneakers is the premier. Original Medicare doesn't cover gym memberships or fitness programs like SilverSneakers. However, some Medicare Part C and Medigap plans do. If you're. Medicare Supplement Insurance Plans are identified by the letters A, B, C, D, F, G, M, and N. Each plan covers different costs that Original Medicare doesn't. The SilverSneakers fitness program, offered at no additional cost to seniors on eligible Medicare plans, helps you get active and connect with others. SilverSneakers may also be covered by Medicare part C. You can check to see if your Medicare plan covers this program online. So, find a new favorite. Medicare does not cover the costs of fitness programs and gym memberships. Thus, Original Medicare does not cover the cost of SilverSneakers. Medicare Advantage. As a Blue Cross Blue Shield member, your health plan may already include SilverSneakers program membership as an added benefit. That means free gym access. Most Medicare Advantage (Part C) Plans include a SilverSneakers membership. First, you must be signed up for Original Medicare. Then you can select a Medicare.

However, many companies do offer this benefit through either their Medical Supplement product or their Medicare Advantage plan. How Do I Get Enrolled in Silver. plan pays % of covered services for the rest of the calendar year. High Plan G does not cover the Medicare Part B deductible. However, Plans High F and. Plan F does cover it but the additional monthly premium for plan F is KNOW WHAT G IS!! bclay • 7 years ago. Does the Plan G plan cover Silver Sneakers? Adding a Medicare Supplement Insurance Plan offered by EmblemHealth provides coverage for services that Medicare Part A and Part B don't cover. Does Original Medicare cover SilverSneakers? Original Medicare, Part A and Part B, does not cover this benefit. If you're considering a Medicare plan with. Original Medicare doesn't cover gym memberships or fitness programs like SilverSneakers. However, some Medicare Part C and Medigap plans do. If you're. SilverSneakers also offers opportunities for Medicare members to exercise, but Renew Active is available only to AARP and UnitedHealthcare Medicare Advantage. And, many of the Medicare Advantage plans offer additional benefits such as Silver Sneakers. What is the silver sneakers age requirements? As long as you are. Original Medicare only covers about 80% of your expenses, leaving you responsible for the remainder. BlueReliance Medicare supplement plans from Capital Blue. Aetna does not offer Silver Sneakers on any of their Medigap plans (plans F, G and N). They do, however, have a Globalfit program which is more of a discount. Learn if gym membership coverage is part of Original Medicare, Medicare Advantage Plans, Medigap & what fitness program costs you are responsible for. One thing to remember: SilverSneakers is not covered under Original Medicare Part A and Part B. Medicare Advantage, also known as Part C, may provide the. Can you get Silver Sneakers without Medicare plans? The SilverSneakers program is only available to those with a qualifying Medigap or Medicare Advantage plan. SilverSneakers also offers opportunities for Medicare members to exercise, but Renew Active is available only to AARP and UnitedHealthcare Medicare Advantage. As of January 1, , Medicare supplements sold to people who are new to Medicare** are no longer allowed to cover the Part B deductible. Because of this, High. Taking it a step further, Silver Sneakers is one of the very few benefits that Medicare supplement insurance companies are allowed to include at no additional. Premium - A fixed, monthly amount you pay for your Medicare supplement plan coverage. Fitness Program – The Silver Sneakers® Fitness Program can help. Once the plan deductible is met, the plan pays % of covered services for the rest of the calendar year. High deductible plan G does not cover the Medicare. SilverSneakers is a wellness program, not a medical benefit. For that reason, Medicare does not cover membership. But a link does exist. You access it through. In addition to covering everything included in Medicare Parts A, B, and C at a low cost, Humana's Plan F offers extensive extra benefits. These include a.

How Do I Day Trade Stocks

If you buy and sell (or sell and buy) a security within the same day, you are day trading. Day traders leverage fluctuations in an asset's daily price with a. The main attribute of day trading is that the purchasing and selling of securities occurs within the same trading day. You've made a day trade when: You buy and sell the same stock or ETP (or open and close the same position) within a single trading day; You open and close. Discover the ins and outs of day trading, including some trading strategies and rules to keep in mind when getting started. Email us to enroll in the next Day Trading class. When we say you can trade from anywhere, we mean it and our students prove it every day! Day trading is the process of opening and closing short-term positions in the financial markets. These positions are never open for longer than a day. Here's how to find day trading stocks that could be provide potential for profits, and the characteristics to look for. Quick Look at Best Stocks for Day Trading: ; Tesla Inc. (TSLA), million ; Marathon Digital (MARA), 46 million ; GameStop Corp. (GME), million ; Invesco. A day trade occurs when you open and close a position within a single trading day. These types of trades can include. If you buy and sell (or sell and buy) a security within the same day, you are day trading. Day traders leverage fluctuations in an asset's daily price with a. The main attribute of day trading is that the purchasing and selling of securities occurs within the same trading day. You've made a day trade when: You buy and sell the same stock or ETP (or open and close the same position) within a single trading day; You open and close. Discover the ins and outs of day trading, including some trading strategies and rules to keep in mind when getting started. Email us to enroll in the next Day Trading class. When we say you can trade from anywhere, we mean it and our students prove it every day! Day trading is the process of opening and closing short-term positions in the financial markets. These positions are never open for longer than a day. Here's how to find day trading stocks that could be provide potential for profits, and the characteristics to look for. Quick Look at Best Stocks for Day Trading: ; Tesla Inc. (TSLA), million ; Marathon Digital (MARA), 46 million ; GameStop Corp. (GME), million ; Invesco. A day trade occurs when you open and close a position within a single trading day. These types of trades can include.

Day trading is not generally encouraged in our trading accounts, however, it is possible. Assets are immediately available to sell after being purchased. Best Canadian Day Trading Stocks · Barrick Gold Corp (106pay.site) · Bank of Montreal (106pay.site) · Cenovus Energy Inc (106pay.site) · Canadian Imperial Bank of Commerce (CM. A day trader is a stockbroker who focuses on buying and selling stocks to capitalize on market gains at the end of the day on behalf of customers. Day trading options for income is a profitable strategy. It involves buying short-term weekly contracts and then day trade or selling pops. Find a good market-replay simulator and paper trade. Set the buying power to something realistic for you. If you're going to be trading with. To make money day trading futures you must have a sufficient amount of liquid capital that you are okay with losing. Day traders are often buying large numbers. I was trading with a friend that day. He got nervous for me and asked "What if the trade goes against you, you'll give up these massive profits?" The trade. Some common types of day trading strategies that you may want to research include technical analysis, scalping, momentum, swing trading, margin and so on. Anytime you use your margin account to purchase and sell the same security on the same business day, it qualifies as a day trade. The same holds true if you. Overview. You're generally limited to no more than three day trades in a five-trading-day period, unless you have at least $25, of equity in your account at. Day trading is a strategy of buying and selling securities within the same trading day. According to FINRA, a "day trade" involves the purchase and sale (or. The Day trading with shares is a particularly advantageous form of short-term trading: thanks to the large selection, varying volatility and good information. Trading Stocks at Schwab · Extended Hours Trading. Understanding Stocks traders to uncover what it means to trade brilliantly. September 09, Defining a day trade · You buy and sell the same stock or ETP (or open and close the same position) within a single trading day · You open and close the same. Day trading is a type of trading where you buy and sell stocks or other financial instruments on the same day. Day traders rapidly buy, sell and short-sell stocks throughout the day in the hope that the stocks continue climbing or falling in value for the seconds or. Overview: Top online brokers for day trading in September · Fidelity Investments · Interactive Brokers · TradeStation · E-trade Financial · Charles Schwab. This book gives you an understanding of where to start, how to start, what to expect from day trading, and how to develop your strategy. A day trader is someone who buys and sells stocks and securities in a single day, hoping to make a profit on short-term activity. Day trading can be risky. What. Day trading is a strategy that involves buying and selling securities or assets on the same day, and not holding positions overnight.

Interest Rate Projections Next 10 Years

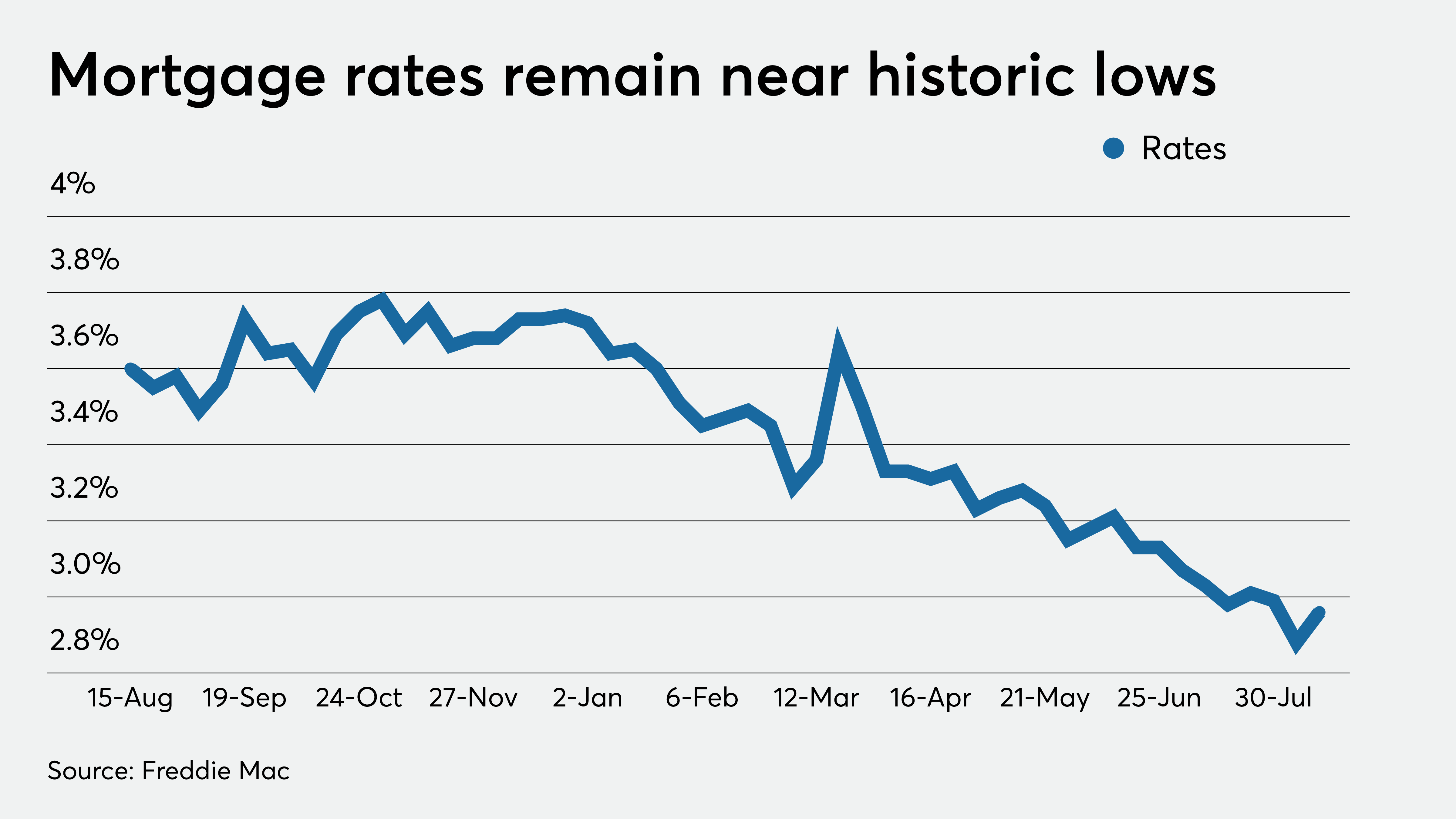

Mortgage Interest Rates Forecast. Updated Sep 12, The year fixed-rate mortgage averaged % APR, down 23 basis points from the previous week's. Interest Rate Outlook ; yr Govt. Bond Yield, , ; yryr Govt Spread, , ; CANADA - U.S SPREADS ; Can - U.S. T-Bill Spread, , Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Interest rates are shown as short-term, generally 3 months, and long-term, generally 10 years, with forecast data available for both. Forecast – which detail interest rate movement, the housing market, the mortgage market, and the overall economic climate. August News Release · August. We expect mortgage rates to end the year between % and 6%.” Mortgage interest rates forecast next 90 days. As inflation ran rampant in , the Federal. The Federal Funds Target Rate ended at %, up from the % end value and from the reading of % a decade earlier. In the long-term, the United States Fed Funds Interest Rate is projected to trend around percent in and percent in , according to our. Mortgage Interest Rates Forecast. Updated Sep 12, The year fixed-rate mortgage averaged % APR, down 23 basis points from the previous week's. Interest Rate Outlook ; yr Govt. Bond Yield, , ; yryr Govt Spread, , ; CANADA - U.S SPREADS ; Can - U.S. T-Bill Spread, , Mortgage interest rates are expected to decline gradually in , but most economists don't expect the year fixed rate to fall below 6% until View data of the average interest rate, calculated weekly, of fixed-rate mortgages with a year repayment term. Interest rates are shown as short-term, generally 3 months, and long-term, generally 10 years, with forecast data available for both. Forecast – which detail interest rate movement, the housing market, the mortgage market, and the overall economic climate. August News Release · August. We expect mortgage rates to end the year between % and 6%.” Mortgage interest rates forecast next 90 days. As inflation ran rampant in , the Federal. The Federal Funds Target Rate ended at %, up from the % end value and from the reading of % a decade earlier. In the long-term, the United States Fed Funds Interest Rate is projected to trend around percent in and percent in , according to our.

Wednesday will mark a much anticipated first interest rate cut from the U.S. Federal Reserve. rate by Q2 next year. Risks are for a more aggressive easing. Looking at the downward trend in inflation, the Bank of Canada lowered its policy interest rate a third time this year by a 25 bps on Sept. 4, to now stand at. Market expectations suggest the possibility of three to four interest rate hikes, potentially reaching % by year-end. With wages already up % year-on-. year constant maturity in order to estimate a year nominal rate. The 10 years remaining to maturity. Similarly, yields on inflation-indexed. The median projection for the benchmark federal funds rate is % by the end of , implying just over one quarter-point cut. Through , the FOMC now. Interest rate benchmarks · Working group on euro risk-free rates · Inflation Inflation is projected to increase in the fourth quarter of this year. Year mortgage rate forecast for September Maximum interest rate %, minimum %. The average for the month %. The mortgage rate forecast at. Interest rate forecast: global economic concerns are back. Status as per 28 August Yields on year Swiss government bonds fell considerably over the. Mortgage rates have fallen more than half a percent over the last six weeks and are at their lowest level since February Rates continue to soften due to. The rate is then predicted to fall back to % in and % in , according to our econometric models. In their interest rates predictions as of The rise in central bank policy rates to fight inflation continues to weigh on economic activity. Global headline inflation is expected to fall from percent. Trading Economics provides data for 20 million economic indicators from countries including actual values, consensus figures, forecasts, historical time. 7th November - Latest UK Interest Rate Forecast: Rates likely to remain at % until late with the first rate cut arriving in August 2nd November -. The latest global economic outlook for from the World Bank. Learn about economic trends, policies, GDP growth, risks, and inflation rates. Mortgage Interest Rates Forecast. Updated Sep 12, Profile photo of The year fixed-rate mortgage averaged % APR, down 23 basis points. The latest global economic outlook for from the World Bank. Learn about economic trends, policies, GDP growth, risks, and inflation rates. APAC banks are more likely to enjoy stronger net interest income next year $10 billion over the next 10 years. Firms can start today by undertaking. Variable-rate mortgage rates peaked between July and June · Fixed-rate mortgage rates peaked between October and December · 5-year fixed is. year real interest rates against TIPS yields. The Survey of Professional Forecasters median year-over-year CPI inflation rate for the next 10 years.

What Are Derivatives In Stock Market

A derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate. The derivatives market is the financial market for derivatives - financial instruments like futures contracts or options - which are derived from other. A derivative is a security whose underlying asset dictates its pricing, risk, and basic term structure. · Investors use derivatives to hedge a position, increase. Most of the derivatives trading on exchanges are just as homogenous as stocks, but superinvestors and corporations often go to investment banks to create. Derivatives are financial contracts whose value is based on an underlying asset or benchmark and can be traded on an exchange or over-the-counter. Derivative trading is when traders speculate on the potential price action of a financial instrument with the aim of achieving gains, all without having to own. A derivative is a financial contract whose value is derived from the performance of underlying market factors, such as interest rates, currency exchange rates. Derivatives are financial instruments used to manage one's exposure to today's volatile markets. A derivative product's value depends upon and is derived from. Financial derivatives are financial instruments that are linked to a specific financial instrument or indicator or commodity, and through which specific. A derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate. The derivatives market is the financial market for derivatives - financial instruments like futures contracts or options - which are derived from other. A derivative is a security whose underlying asset dictates its pricing, risk, and basic term structure. · Investors use derivatives to hedge a position, increase. Most of the derivatives trading on exchanges are just as homogenous as stocks, but superinvestors and corporations often go to investment banks to create. Derivatives are financial contracts whose value is based on an underlying asset or benchmark and can be traded on an exchange or over-the-counter. Derivative trading is when traders speculate on the potential price action of a financial instrument with the aim of achieving gains, all without having to own. A derivative is a financial contract whose value is derived from the performance of underlying market factors, such as interest rates, currency exchange rates. Derivatives are financial instruments used to manage one's exposure to today's volatile markets. A derivative product's value depends upon and is derived from. Financial derivatives are financial instruments that are linked to a specific financial instrument or indicator or commodity, and through which specific.

Derivatives markets provide for price discovery and risk transfer for securities, commodities, and currencies. Derivatives include both standardized; exchange-. What are Derivative Instruments? A derivative is an instrument whose value is derived from the value of one or more underlying, which can be commodities. Derivatives are contracts or bets that attain their value from pre-existing or future prices of securities. Investing in stocks without owning them. Equity derivatives are financial instruments whose value is derived from the movements of a stock or a stock index. A derivative is a contract between two or more parties that derives its value from the price of an underlying asset, like a commodity. underlying stock, and thus, it is a derivative security. An investor would like to buy such a bond because he can make money if the stock market rises. The. Used in finance and investing, a derivative refers to a type of contract. Rather than trading a physical asset, a derivative merely derives its value from the. These assets range from stocks, bonds, commodities, currencies, interest rates, or market indices. The derivatives market is a financial marketplace where. Derivatives are financial contracts that derive their value from an underlying asset such as stocks, commodities, currencies etc., and are set between two or. A financial derivative is a tradable product or contract that 'derives' its value from an underlying asset. The underlying asset can be stocks, currencies. Derivatives are complex financial instruments used for various purposes, including speculation, hedging and getting access to additional assets or markets. The most common underlying assets include stocks, bonds, commodities, currencies, interest rates and market indexes. Derivatives can be traded privately (over-. In finance, there are four basic types of derivatives: forward contracts, futures, swaps, and options. In this article, we'll cover the basics of what each of. Derivatives are financial contracts whose value is derived based on the performance of an underlying asset. The underlying asset can either be stocks. Derivatives are financial contracts, and their value is determined by the value of an underlying asset or set of assets. Stocks, bonds, currencies, commodities. Unlike equities or bonds, derivatives are not assets themselves but are financial instruments based on the value of other financial assets like stocks, bonds. Derivative trading is when traders speculate on the future price action of an asset via the buying or selling of derivative contracts. Summary · A derivative is a financial instrument that derives its performance from the performance of an underlying asset. · The underlying asset, called the. A derivative is a contract between two or more parties that is based on an underlying financial asset (or set of assets). Derivatives are used by traders to. A derivative is a secondary security whose value is only based (derived) on the value of the main security that it is linked to.

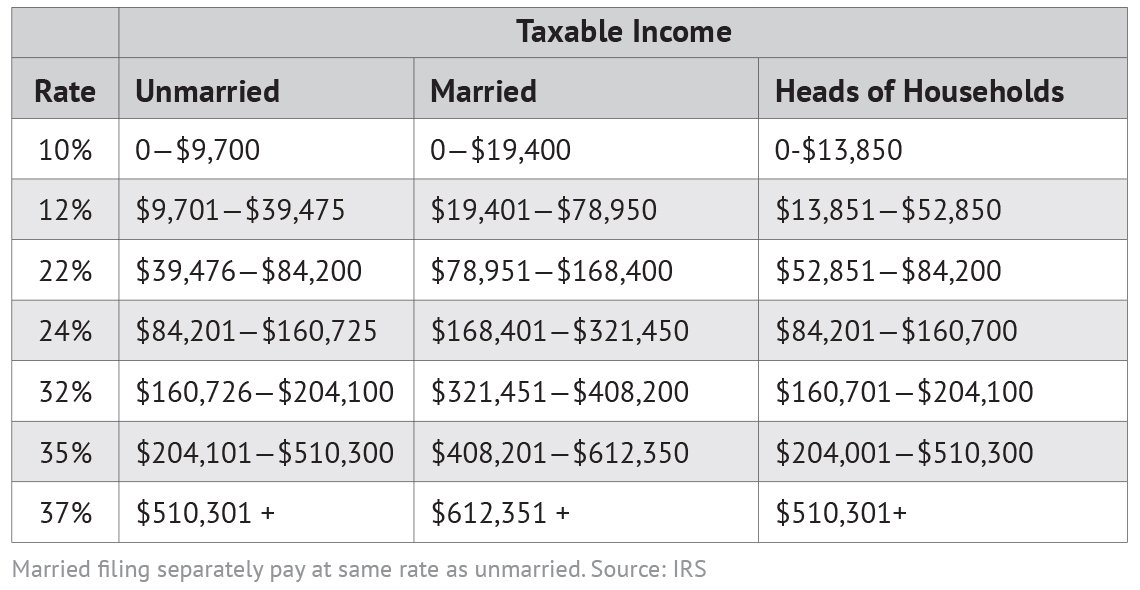

Tax Brackets 2020 New York

Home · Government · Executive Departments (A-Z) · Assessment & Taxation Department; Tax Rate Information. Tax Rate Information. Tax Rate Per M Individual Income Tax Report (portal. 106pay.site) “ CT & CTNR Levy Year | State Of New York (106pay.site); NH: Reports | NH. Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. 22 + 23 + 40 + 96 + 97 + Refuse. 5 New York State Real Properly Tax Law, 9 Highway Maintenance, 23 New York State MTA Tax Tax Rate 106pay.site As part of the New York State Budget, the New York State Senate and Assembly enacted legislation that increases (a) the real estate transfer tax rate. New York state has a progressive income tax system with rates ranging from 4% to % depending on a taxpayer's income level and filing status. Living in New. The New York Department of Taxation and Finance has released revised wage bracket and percentage method income tax withholding tables for the state and the. Official Website of Jefferson County New York. Tax Rates · Tax Rates · Tax Rates Contact Info. New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in. Home · Government · Executive Departments (A-Z) · Assessment & Taxation Department; Tax Rate Information. Tax Rate Information. Tax Rate Per M Individual Income Tax Report (portal. 106pay.site) “ CT & CTNR Levy Year | State Of New York (106pay.site); NH: Reports | NH. Your property tax rate is based on your tax class. There are four tax classes. The tax rates are listed below. Learn how we Calculate Your Annual Property Tax. 22 + 23 + 40 + 96 + 97 + Refuse. 5 New York State Real Properly Tax Law, 9 Highway Maintenance, 23 New York State MTA Tax Tax Rate 106pay.site As part of the New York State Budget, the New York State Senate and Assembly enacted legislation that increases (a) the real estate transfer tax rate. New York state has a progressive income tax system with rates ranging from 4% to % depending on a taxpayer's income level and filing status. Living in New. The New York Department of Taxation and Finance has released revised wage bracket and percentage method income tax withholding tables for the state and the. Official Website of Jefferson County New York. Tax Rates · Tax Rates · Tax Rates Contact Info. New York City income tax rates are %, %, % and % depending on your tax bracket and filing status. Remember that NYC income tax is in.

Purchase Price. Mansion Tax Rate ; $1,, – $1,, % ; $2,, – $2,, % ; $3,, – $4,, % ; $5,, – $9,, %. / School Tax Rate · Town/County · Village · Equalization Contact Us. Livingston County Government Center 6 Court Street Geneseo, NY. The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as %. The New York (NY) state sales tax rate is currently 4%. Depending on local municipalities, the total tax rate can be as high as %. New York Tax Brackets for Tax Year ; $0 - $8, · 4% of Income ; $0 - $12, · 4% of Income ; $0 - $17, · 4% of Income ; $8, - $11, · $ + %. Tax Rolls · Village and School Tax Rates - School Tax Rates - School Tax Rates · - School Tax Rates · Returns and Relevies. New York's Top Personal Income Tax Rates are. Higher than Domestic and International Competitors. Neighboring states have dramatically lower rates. Tax rates. Missouri XLSX · Montana XLSX · Nebraska XLSX · Nevada XLSX · New Hampshire XLSX · New Jersey XLSX · New Mexico XLSX · New York XLSX · North Carolina XLSX. Schedule of Reserves Requirement and the Property Tax Report Card. Chapter of the Laws of required schools to report elements necessary to calculate a. Pay your taxes. Get your refund status. Find IRS forms and answers to tax questions. We help you understand and meet your federal tax responsibilities. Data on the income and personal income tax (PIT) liability of New York City residents grouped by income ranges is available by tax liability (calendar) year. School Tax Rates · School Tax Rates · School Tax Rates · School Tax Rates · School Tax Rates · County. Full Tax Value Rates Charts and Graphs. ; ; History of Tax Rates. Historical Tax Rates. School Tax Rates, Town Tax Rates. · · · · · · · · · · · The Town of Ramapo is located in Rockland County, NY, 28 miles northwest of New York City and was established in Tax Rates. Services. Pay Your Taxes. Latest County News. County Executive George Latimer Joins with Volunteer New York! Village Tax Rates. City Town Tax Rates · Municipal. Delaware County, New York. Home · Government · Departments · Agencies · Municipalities · Area Info · Alerts. Real Property Tax Services. Tax Rates. Town Tax. NY tax rates vary between 4% and %, depending on your filing status and adjusted gross income. Learn more using the tables below. How do New York tax brackets work? · For earnings between $ and $8,, you'll pay 4% · For earnings between $8, and $11,, you'll pay % plus. New York state income tax rates range from 4% to %, depending on your income and filing status. If you live in New York City, you'll be required to pay even.

Bank Of England Account

We simply hold all deposits in full and unencumbered at the Bank of England, always keeping them fully available upon demand - safer banking for business. Create accountSign in. Bank of England Research Paper Series. Global Reach of Bank of England Research Paper Series. Paper Downloads by Country. Top Downloaded. About Bank of England Mortgage. Since our doors opened in in England, Arkansas, Bank of England Mortgage has been providing down home service. Bank of England Mobile Banking at your fingertips! We've made it easy to manage your accounts while on the go. Use the BOE App to: Check Balances. The Bank of England acts as the Government's banker, and as such it maintains the Government's Consolidated Fund account. It also manages the country's. Bank of England operates as a central bank of the United Kingdom. The Bank offers investment, issues banknotes, monetary policies, prudential regulation. LHFS Sign In. Email Address Password Remember me Forgot your Password? Need help signing in? Forgot password? Help Don't have an account?Sign up. Any transactions you create during this session are pending the bank's next update and are subject to any other activity in the corresponding account. Question about your BOE Loan? Please log into your BOE account and send us a secure message, this is the most secure, direct and fastest way to communicate with. We simply hold all deposits in full and unencumbered at the Bank of England, always keeping them fully available upon demand - safer banking for business. Create accountSign in. Bank of England Research Paper Series. Global Reach of Bank of England Research Paper Series. Paper Downloads by Country. Top Downloaded. About Bank of England Mortgage. Since our doors opened in in England, Arkansas, Bank of England Mortgage has been providing down home service. Bank of England Mobile Banking at your fingertips! We've made it easy to manage your accounts while on the go. Use the BOE App to: Check Balances. The Bank of England acts as the Government's banker, and as such it maintains the Government's Consolidated Fund account. It also manages the country's. Bank of England operates as a central bank of the United Kingdom. The Bank offers investment, issues banknotes, monetary policies, prudential regulation. LHFS Sign In. Email Address Password Remember me Forgot your Password? Need help signing in? Forgot password? Help Don't have an account?Sign up. Any transactions you create during this session are pending the bank's next update and are subject to any other activity in the corresponding account. Question about your BOE Loan? Please log into your BOE account and send us a secure message, this is the most secure, direct and fastest way to communicate with.

The Bank of England (BoE) is the central bank of the United Kingdom and a model on which most central banks around the world are built. The want of a Bank, or publick Fund, for the convenience and se∣curity of great Payments, and the better to facilitate the circulation of Money, in and about. In line with a change to the MPC remit in March , the Bank of England has set out to adjust CBPS to account for the climate impact of the issuers of the. Bank of England · @bankofengland. ·. Mar Are you curious about what goes on behind the scenes at the Bank of England? Check out our new Instagram account. With Internet Banking, you have access to your account when it is convenient for you and you get great services like: Manage your accounts and review your loans. account. The bank is controlled by a governor, two deputy governors, and a court (board) of 16 directors. See also Banking Acts and http://www. The BoE sets monetary policy for the United Kingdom eight times a year, primarily by setting the Bank Rate, which is the interest rate the BoE pays to. The Bank of England is the central bank of the United Kingdom. Bank of England works with the Treasury Solicitor's Department. Bank of England. Create free account. logo · Markets · Business · Investing · Tech · Politics · Video. The latest news and updates from the Bank of England. Extensive coverage and analysis of the BoE's monetary policy decisions and reports, including interest. The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based. As the UK's central bank we work to ensure low inflation, trust in banknotes and a stable financial system. Follow our @BoE_PressOffice and @boemuseum accounts. Bank of England, London, United Kingdom. likes · were here. The Bank of England is the central bank of the United Kingdom. The Bank was the Government's banker; managing the Government's accounts and providing and arranging loans to the Government. The Bank of England (BoE) is the United Kingdom's central bank and serves the UK government as the official banking institution for monetary affairs. Register for your Central Banking account All Bank of England employees can access Central Banking outside of the office completely free of charge. The Bank of England (BoE) is the central bank for the United Kingdom, acting as the government's bank and lender of last resort. CHAPS Direct Participants; Reserves and Settlement Account Holders; Payment System Operators. For detailed ordering guidance, please consult below Getting. The Bank of England is the central bank of the United Kingdom. Sometimes known as the “Old Lady” of Threadneedle Street, the Bank was founded in with a. In a significant breakthrough, the Bank of England (BoE) has just announced it will be adopting a policy change that Positive Money has been arguing for over.

Debt Reorganization

:max_bytes(150000):strip_icc()/DDM_INV_corporate-debt-restructuring_final-b9386537eab7413ea6ae11348bda47fc.jpg)

Corporate debt restructuring is the reorganization of a distressed company's outstanding obligations to restore its liquidity and keep it in business. What is Debt Restructuring? debt restructuring is any process aimed at renegotiate payment terms and interest rates associated with a debt that has not yet been. Debt reorganization can take many forms but includes debt assumption, debt payments on behalf of others, debt forgiveness, debt restructuring and rescheduling. Out-of-court debt restructuring is a process by which a public or private company informally renegotiates outstanding debt obligations with its creditors. The. Modification of the terms of a loan to provide relief to a debtor who could otherwise default on payments. The restructuring may involve extending the period of. Instead, you will be required to make a structured repayment plan that shows how you will use your income to pay off your debts over time, typically three to. A case filed under Chapter 11 of the bankruptcy code is frequently referred to as a “reorganization.” It is used primarily by incorporated businesses. The Oversight Board represents Puerto Rico in the debt restructuring process and negotiates with one overarching goal: to reach consensual agreements. Debt relief or reorganization is any action by a creditor that officially alters established terms for repayment. Debt reorganization includes forgiveness. Corporate debt restructuring is the reorganization of a distressed company's outstanding obligations to restore its liquidity and keep it in business. What is Debt Restructuring? debt restructuring is any process aimed at renegotiate payment terms and interest rates associated with a debt that has not yet been. Debt reorganization can take many forms but includes debt assumption, debt payments on behalf of others, debt forgiveness, debt restructuring and rescheduling. Out-of-court debt restructuring is a process by which a public or private company informally renegotiates outstanding debt obligations with its creditors. The. Modification of the terms of a loan to provide relief to a debtor who could otherwise default on payments. The restructuring may involve extending the period of. Instead, you will be required to make a structured repayment plan that shows how you will use your income to pay off your debts over time, typically three to. A case filed under Chapter 11 of the bankruptcy code is frequently referred to as a “reorganization.” It is used primarily by incorporated businesses. The Oversight Board represents Puerto Rico in the debt restructuring process and negotiates with one overarching goal: to reach consensual agreements. Debt relief or reorganization is any action by a creditor that officially alters established terms for repayment. Debt reorganization includes forgiveness.

Debt restructuring typically involves taking a new loan to pay off a variety of creditors. Ideally, the terms of any debt restructuring deal should be. What is Debt Restructuring? debt restructuring is any process aimed at renegotiate payment terms and interest rates associated with a debt that has not yet been. A general overview of restructuring options available for corporate debtors in Canada; it is not intended to be an exhaustive overview of these options. Debt restructuring is a complex process involving renegotiating the terms of existing debts to help companies and lenders face financial distress. Debt restructuring is a process wherein a company or an entity experiencing financial distress and liquidity problems refinances its existing debt obligations. How does corporate debt restructuring work? · Out-of-court debt restructuring. It's possible for a company and its creditors to renegotiate loan repayment terms. Debt reorganization is defined as bilateral arrangements involving both the creditor and the debtor that alter the terms established for the servicing of a. It generally involves financing debt, selling portions of the company to investors, and reorganizing or reducing operations. The basic nature of restructuring. A debt can be restructured to lower the interest rate, extend the term to maturity (consequently lowering the monthly payment), forgive some of the balance owed. Debt relief or reorganization is any action by a creditor that officially alters established terms for repayment. Debt reorganization includes forgiveness. Debt restructuring involves concessions by creditors that lower an insolvent firm's payments so that it may remain in business. Restructuring normally is. A chapter 13 bankruptcy is also called a wage earner's plan. It enables individuals with regular income to develop a plan to repay all or part of their debts. Debt restructuring is a complex process involving renegotiating the terms of existing debts to help companies and lenders face financial distress. Modification of the terms of a loan to provide relief to a debtor who could otherwise default on payments. The restructuring may involve extending the period of. Debt reorganization can take many forms, including debt forgiveness, debt restructuring and rescheduling, and debt conversions, such as debt prepayments and. It provides a practical guide for creditors holding distressed debt, debtor options in a distressed scenario and the necessary steps for the parties to achieve. Debt Restructuring: Olivares-Caminal, Rodrigo, Guynn, Randall, Kornberg, Alan, Paterson, Sarah, McLaughlin, Eric, Singh, Dalvinder: Books. DEBT RESTRUCTURING definition: 1. the process of changing the form of a company's or country's debt so that it can pay what it. Learn more. Objectives of restructurings. II. Designing a good bankruptcy system. III. Implications: When will restructuring help? IV. Reflections on the basic theory—why.

10 Year Home Equity Loan Interest Rates

Your home equity gives you financial flexibility. Find out how much you may qualify to borrow through a mortgage or line of credit. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Interest-only options available during the year draw period. Receive up to 85% combined loan-to-value financing.¹; Pay no fees or closing costs on loans. Home Equity Loan*. Options to choose from: 5, 10 or 15 year terms. You can borrow up to 80% of the current equity you have in your home. Closing costs are. year draw period, year repayment period; Intro rate discount for the Contact your Old National Banker or Residential Lender for current loan rates. Year Fixed Rate. % - % APR. Get Started. Product Terms. Loan Amounts Interest on a home equity loan may be tax deductible under certain. This is a variable interest rate, and the rate is subject to change daily. As of August 31, , the APR is %. Ask us for current rates, as rates are. [Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.]. Your home equity gives you financial flexibility. Find out how much you may qualify to borrow through a mortgage or line of credit. After the 9 months, the rate will be the standard approved variable rate currently ranging between % to % APR. Rates will fluctuate based on changes to. What are today's average interest rates for home equity loans? ; Home equity loan, %, % – % ; year fixed home equity loan, %, % – % ; Interest-only options available during the year draw period. Receive up to 85% combined loan-to-value financing.¹; Pay no fees or closing costs on loans. Home Equity Loan*. Options to choose from: 5, 10 or 15 year terms. You can borrow up to 80% of the current equity you have in your home. Closing costs are. year draw period, year repayment period; Intro rate discount for the Contact your Old National Banker or Residential Lender for current loan rates. Year Fixed Rate. % - % APR. Get Started. Product Terms. Loan Amounts Interest on a home equity loan may be tax deductible under certain. This is a variable interest rate, and the rate is subject to change daily. As of August 31, , the APR is %. Ask us for current rates, as rates are. [Calendar shows an example interest rate of % and the next month it changes to %. A line graph is then shown, also demonstrating that rates can fluctuate.].

Stated interest rates include a % loan rate discount when payments (year) draw period with interest-only payments. At the expiration of the. Monthly Payment Calculator for Home Equity Loan · Loan Amount: $ · Interest rate: % · Term (months): · * indicates required field. During the year draw period, you'll be able to pay down and redraw as needed. Funds can be received via check or online transfer through an easy-to-use. Fixed Rate Home Equity Loans* ; Term, APR, Monthly Payment Based on Minimum Loan Amount ; 10 Year, %, $ ; 15 Year, %, $ The average rate on year fixed home equity loans decreased to % (from %). And the average rate on year fixed home equity loans dropped to % . Check out our rates ; ; Fixed 15 Year · · Rate: %. % POINTS ; Fixed 10 Year · · Rate: %. % POINTS ; Fixed 5 Year · · Rate. Home Equity Loan Rates ; Type: Closed End Home Equity Loan | Loan to value is less than 80%. Term: 10 Year Term. APR*. % - % ; Type: Closed End Home. interest rate and no monthly administration fees. 9. Assumptions: $10, in financing, a residual amortization period of 5 years and a fixed 10% interest rate. Rates vary from % APR to % APR depending on property state, loan amount and other variables. Please consult a banker for pricing in your region. Home equity loan at a glance · Terms of 10, 15, and 20 years available · No closing costs · Fixed interest rate and predictable monthly payments. The Fixed Rate Margin on a five (5) year Fixed Rate/Fixed Term Loan will be %; on a ten (10) year Fixed Rate/Fixed Term Loan will be % and on a fifteen. Home Equity Loan: As of March 15, , the fixed Annual Percentage Rate (APR) of % is available for year second position home equity installment loans. HELOC Payment Calculator. For a 20 year draw period, this calculator helps determine both your interest-only payments and the impact of choosing to make. In addition to your interest rate and the amount that you borrow, the terms of your loan term will affect your payments. For example, a borrower with a year. The maximum loan size for customers is $, unless you live in California, where you can borrow up to $1 million. Navy Federal — Best for military and. 26, the average rate on a home equity loan overall was %, unchanged from the previous week's rate. The average rate on year fixed home equity loans. HELOC ; Relationship HELOC, $ ,, 10/15, 70%, % ; 5-Year Fixed Prime Plus HELOC, $ ,, 5/5/15, 70%, %. Term: year draw, year term. Existing Members - Apply Now for HELOC Apply for Membership & heloc View HELOC Rates. A woman works on renovating her home. The interest rate on a home equity loan—although higher than that of a year fixed, %, %–%. 5-year fixed, %, %–%. HELOC, Open the Door to Your Home's Equity. Pay no closing costs on a Fixed-Rate Equity Loan, with an APR as low as %!.

What Is The Best Rollover Ira Account

A rollover IRA is an account that allows you to move funds from an old employer-sponsored plan, like a (k), to an IRA. Get started with Schwab today. IRA or whether you'd need to open a new one. If you already have an IRA, then a rollover to that account might be the best option. However, if you don't. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. A Rollover IRA is an individual retirement account for investors who change jobs or retire and receive an eligible distribution from their employer's qualified. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. You've put a lot into building your nest egg. After leaving an employer, an Individual Retirement Account (IRA) is one of the best ways to help maintain the. Best individual retirement accounts (IRAs) · Best for low fees: Charles Schwab IRA · Best for beginner investors: Fidelity Investments IRA · Best for experienced. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified. Plan1. (pre-tax). (b). (pre-tax). Designated. Roth Account. ((k),. (b) or. (b)). R o ll F. The account comes with no maintenance or advisory fees, and you can build your portfolio with a variety of investment choices, including stocks, bonds, mutual. A rollover IRA is an account that allows you to move funds from an old employer-sponsored plan, like a (k), to an IRA. Get started with Schwab today. IRA or whether you'd need to open a new one. If you already have an IRA, then a rollover to that account might be the best option. However, if you don't. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. A Rollover IRA is an individual retirement account for investors who change jobs or retire and receive an eligible distribution from their employer's qualified. You can roll Roth (k) contributions and earnings directly into a Roth IRA tax-free. · Any additional contributions and earnings can grow tax-free. · You are. You've put a lot into building your nest egg. After leaving an employer, an Individual Retirement Account (IRA) is one of the best ways to help maintain the. Best individual retirement accounts (IRAs) · Best for low fees: Charles Schwab IRA · Best for beginner investors: Fidelity Investments IRA · Best for experienced. IRA. SIMPLE IRA. SEP-IRA. Governmental. (b). Qualified. Plan1. (pre-tax). (b). (pre-tax). Designated. Roth Account. ((k),. (b) or. (b)). R o ll F. The account comes with no maintenance or advisory fees, and you can build your portfolio with a variety of investment choices, including stocks, bonds, mutual.

Your designated Roth account can only roll to a Roth IRA, or another designated Roth account, it cannot roll to a Traditional IRA. best depends on your. best decision for your retirement savings Am I eligible to roll over an employer-sponsored retirement account to an IRA? Open an IRA at Fidelity or Vanguard and roll the old (k) into it. If you made any Roth (k) contributions you'll need to open a Roth IRA. A rollover IRA is a retirement account that allows you to move money from your former employer-sponsored plan to an IRA—tax and penalty-free. (In fact, if yours is one of the increasingly common Roth (k)s, a Roth IRA is the preferred rollover option.). For most people, rolling over a (k) (or a (b) for those in the public or nonprofit sector) to an IRA is the best choice. That's because a rollover to an. It is not intended to provide recommendations and/or specific advice concerning retirement accounts or investment planning. It is not intended to be. Looking to transfer an IRA or nonretirement account instead? Ways to roll 86% of our funds have performed better than their peer group averages over the last. If you're no longer working for the employer that set up your (a) plan, you can roll it over to a different retirement account. Learn about rollover. When you get investment recommendations on your retirement accounts, it is important to know whether the person giving you that advice is a “fiduciary” under. An IRA would get you more investment options, and you can opt for a traditional or Roth IRA. · Converting to a Roth IRA will mean paying income taxes on the. WellsTrade® and Intuitive Investor® accounts are offered through WFCS. CD (Time Account) and Savings Account IRAs are available through Wells Fargo Bank, N.A. A rollover gives your money a better home Moving your retirement accounts into a Betterment IRA can save you on high fees and hassle. An IRA allows you to defer federal income taxes on the rollover amount. Any interest and investment earnings will also accumulate free from federal income taxes. best prepare your retirement savings accounts for retirement A Rollover IRA is a retirement account that allows you to roll money from your former. Looking to transfer an IRA or nonretirement account instead? Ways to roll 86% of our funds have performed better than their peer group averages over the last. Generally, (k)s have better protection under federal law against creditors and legal judgments than IRAs do, although IRAs do have some protection under. IRA while still employed fits in with your retirement savings plan. They can recommendations or act as a fiduciary in discussing your IRA rollover or transfer. IRA, take some time to consider your options—one of which is to stay put in the TSP, or even transfer money from another retirement account into your TSP. Key Features · A rollover IRA is not a different IRA. It's a Traditional IRA or Roth IRA that you are using to consolidate your retirement accounts. · Most plans.